SFIL is a public investment bank specializing in granting loans to cities. This financial institution works for the development of territories and exports.

Since its creation in 2013, SFIL has become the 7th largest bank in France and the leading public sector funder in the country.

Their project: SFIL wishes to simplify and accelerate its loans review process in two ways:

– consolidate all case file information into a single dashboard

– score the case files to simplify the work of SFIL loans experts.

Their Challenges:

Ensuring the accuracy of information contained in loan grant requests is an essential strategic mission for all banks around the world. This task is very time consuming, however, and has to be done perfectly to make sure that the financial organization does not take on the risk of losing money from the loans they grant.

SFIL has a dozen analysts who work full time reviewing complex case files in order to approve or refuse loans to the public clients of the financial institution. Each of these analyses can take hours to complete, and requires the review of large volumes of heterogeneous data by internal experts. These tasks take tremendous amounts of time for SFIL and slow down the whole process of loan granting analysis.

Lacking an easy way to accelerate this highly time consuming process, SFIL reached out toProvision.io for an answer to their problems. It was very important to them that the solution be a combination of machine learning and human personnel.

What the team needed was to be able to accelerate the loan review process in order to free their team up to work on other strategic tasks.

This reduction in lost time could occur in two ways:

- The centralization of all case files information in a single dashboard to help SFIL teams have access to all the needed data more easily.

- The scoring of those files into 2 different categories to help facilitate treatment of the easiest to review files first.

Provision.io’s response

Thanks to Provision.io’s AI platform, SFIL teams found a simple way to accelerate their tasks by automating some parts of their case review process, and by having access to decision support.

Using Provision.io’s AI platform, a model was built to help automate the scoring of loan granting cases.

This particular model was constructed to provide answers for two challenges in particular:

- It had to be an “on demand” scoring model to allow SFIL teams to organize their work as theywanted & the calculation time had to be short (less than 30 seconds).

- The model also had to deliver as few false positives as possible, and to be viable enough for SFILteams to gain time when reviewing data.

The model, which was created with the Provision.io platform, analyses several datasets comingfrom several sources:

- The case file data related to each individual case and which will differ with each client (amount of the loan, duration of the loan, type of requested loan, etc.)

- City data that are related to the global situation of each of the clients (population, detailed budgets, existing loans, risk scores, etc.)

- Other computed indicators (projected interest amount, savings amount, projected debts, etc.)

Thanks to this data, the model is able to deliver predictions following 12 business rules that havebeen defined with the client.

When all of the rules that have been established are validated, the case file gets sorted into the “easy reviewing” category, which lets the SFIL teams know that these cases will take less time to review than others.

However, if one of those business rules is not valid, the case has to be further reviewed by theexpert analysts.

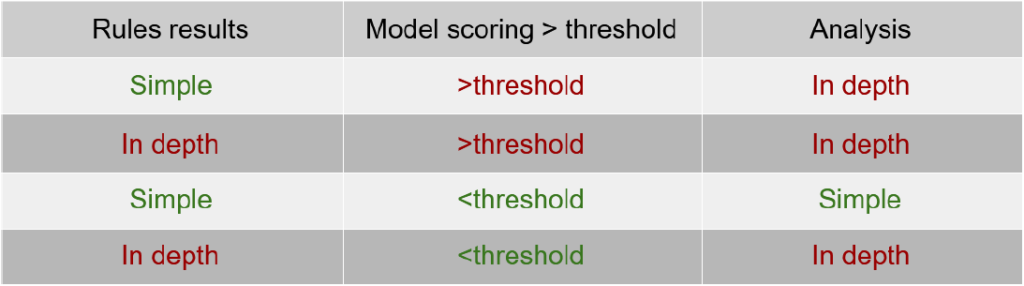

The following process has been defined:

Benefits to SFIL:

The Provision.io AI management platform has enabled SFIL teams to gain valuable extra time when reviewing their loan granting case files.

Thanks to the preliminary automated review of case files, SFIL teams have advanced knowledge of which files will take less time to review. This decision support helps expert analysts spend drastically less time on “easy” files and more time on the ones that need more advanced technical work.

Before the implementation of Provision.io’s platform, SFIL’s team of experts had to spend several hours on each of the files.

Thanks to the predictions of the model, their time now gets spent only on the loan granting case files that require the in-depth analysis skills of a human.

The model, as implemented in the Provision.io platform, is available on a dedicated business app which was built in order to facilitate easy access to predictions for the SFIL experts. This all-in-one interface allows SFIL teams to deploy, monitor, and retrain models all in the same place, while also providing easy access to their forecasts.