Crédit Foncier is a real estate financing arm of BPCE Group. With more than 36million customers worldwide and 9 million members, BPCE Group is the second largest banking group in France.

Their project: Predict the risk of non-payments by automatically identifying which clients areentering the collection process.

Their Challenges

Today more than ever, the inevitable economic consequences of the current global health crisis are clear.

The financial sector in particular is feeling the effects, especially when it comes to the risks of debt collection difficulties. Worldwide instability is forcing financial institutions to deal with business failures—and a sharp increase in the number of unpaid debts.

Crédit Foncier’s teams deal with customers entering the collection process on a daily basis. Customers in danger of not being able to repay their loans are particularly vulnerable. Some sort of intervention is necessary to help them avoid non-payment. This ongoing management is a major challenge that requires a lot of bandwidth and has major strategic considerations.

Lacking a solution to automatically identify the most at-risk cases, Crédit Foncier team members had to manually call each customer entering the collection process.

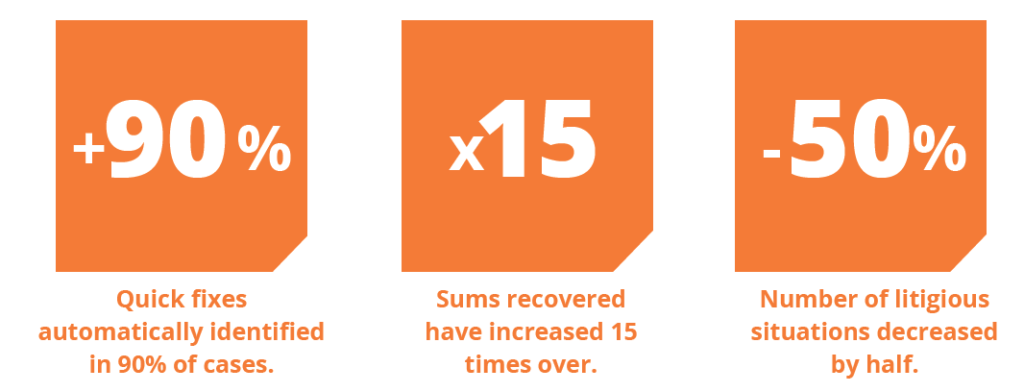

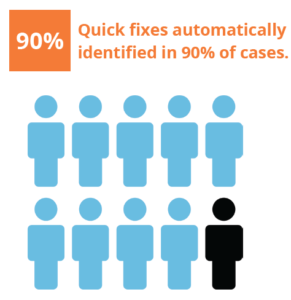

This type of case-by-case management was both time-consuming and a significant waste of time for the team. In almost 90% of cases, the customer is able to resolve the collection situation quickly on their own.

What the team needed was to be able to identify the most at-risk customers ahead of time and rapidly implement mutually beneficial solutions to get these customers back on track. In doing so,they’d not only save precious time, but also prevent the risk of an influx of unpaid debts.

Provision.io’s response

In Provision.io’s enterprise AI platform, Crédit Foncier found a simple way to manage the risks ofnon-payment and optimize its collection process.

Thanks to the platform, the team was able to create a model that signficantly accelerates the processing of collection cases and identifies at-risk customers early on, so that advisors can make the right decisions quickly to rectify the situation. The model also:

- Helps the team understand whether unpaid debts are linked to a temporary or more structural problem.

- Allows the team to have a daily overview of the behavior of their customer base—and step in immediately in the case of risk of non-payment by a customer, with fees and other actions.

- Sends operators suggestions for actions that can help lower the risks of non-payment.

“Provision’s platform has given us a reliable predictive and prescriptive solution to help us and our clients in loan recovery. Task automation has been a key factor in our teams’ improved success.”

Anne Cornet

Executive Director, Credit Foncier / Group BPCE

At the same time, Crédit Foncier rebound team used Provision.io’s platform to automate anotherset of tasks related to predicting early loan repayment requests. In this case, the model:

- Pulls from various financial and operational datasources to anticipate requests for early repayment of loans for repurchase within six months.

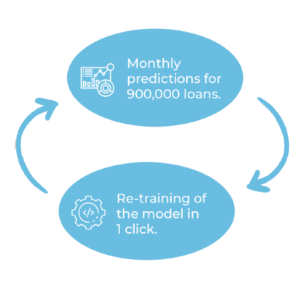

- Offers a new prediction of the probability of early repayment requests for approximately 900,000loans every month.

- Adds an additional line of history for each outstanding loan every month.

Can be completely retrained every month at the click of the button.

The Provision.io Enterprise AI platform has enabled Crédit Foncier teams to obtain important results quickly, and benefit from an intuitive business app that recommends the best “next best action” to take.

It also clearly explains the reasons for each recommendation, and allows users to provide feedback.

The model, as implemented on Provision.io, functions as an intuitive business app that drastically improves the impact of each potential action inherent in the collection process. Armed with the ability to anticipate early repayment requests, the team boosts customer retention and limits the leakage of outstanding balances.

As a result, in just a few weeks, the teams were able to start finding mutually beneficial solutions more quickly in 90% of cases.

In addition, the decrease in the default rate and the optimization of collection processes linked to clear predictions and more reliable back office procedures have allowed Crédit Foncier to reduce its amount of collection cases undertaken by 50%. This significant decrease guarantees a drastic improvement in productivity and efficiency across the department.